The intersection of artificial intelligence and cryptocurrency trading has evolved dramatically since I first deployed my first machine learning model to trade Bitcoin back in 2019. What started as simple pattern recognition algorithms has transformed into sophisticated systems capable of processing terabytes of market data, sentiment signals, and on-chain metrics to execute profitable trades with minimal human intervention.

As someone who’s navigated both the bull markets and the crushing bears over the past six years, I’ve witnessed firsthand how AI strategies that thrive in one market condition can falter in others. The most successful traders I know aren’t relying on a single approach—they’re strategically deploying multiple AI methodologies synchronized to capitalize on different market inefficiencies.

In 2025, we’re seeing a significant advantage shift toward traders utilizing custom-trained AI models. Exchange data from Q1 shows that accounts using sophisticated AI systems are outperforming traditional traders by an average of 18.7% on monthly returns while simultaneously reducing drawdowns by nearly 23%. This isn’t just incremental improvement—it’s a fundamental reshaping of what’s possible in crypto trading.

Let’s dive into the AI strategies that are actually generating consistent profits in today’s complex markets.

Table of Contents

- The Evolution of AI in Crypto Trading

- Strategy #1: Sentiment-Augmented Momentum Trading

- Strategy #2: Deep Reinforcement Learning for Market Making

- Strategy #3: On-Chain Analytics Prediction System

- Strategy #4: Multi-Timeframe Transformer Architecture

- Strategy #5: Adaptive Grid with Volatility Prediction

- Strategy #6: News-Based Event Trading System

- Strategy #7: Hybrid Human-AI Decision System

- Implementation Considerations for All Strategies

- FAQ: AI Trading Strategies

- Conclusion: Building Your AI Trading Advantage

The Evolution of AI in Crypto Trading

Before examining specific strategies, it’s crucial to understand how we arrived at the current landscape:

Early Implementations (2017-2020)

The first wave of AI trading in crypto focused primarily on:

- Basic technical analysis automation

- Simple pattern recognition

- Rules-based decision trees

- Rudimentary backtesting frameworks

Middle Generation (2020-2023)

As markets matured, we saw the emergence of:

- Natural language processing for news analysis

- Supervised learning for pattern identification

- Basic predictive price modeling

- Integration of multiple data sources

Current Generation (2023-2025)

Today’s most profitable systems leverage:

- Deep reinforcement learning architectures

- Multimodal data fusion techniques

- Transfer learning from traditional markets

- Adaptive risk management protocols

- On-chain analytics integration

Strategy #1: Sentiment-Augmented Momentum Trading

Core Concept

This strategy combines traditional momentum indicators with real-time sentiment analysis from multiple data sources to identify high-probability trend continuations and reversals.

Implementation Components

Sentiment Data Sources

| Source Type | Weight | Refresh Rate | Signal Value |

|---|---|---|---|

| Twitter/X | 25% | Real-time | Early trend identification |

| Reddit/Crypto Forums | 20% | 15 minutes | Community sentiment |

| News Headlines | 30% | 5 minutes | Major market catalysts |

| GitHub Activity | 15% | Daily | Project development health |

| Exchange Inflows/Outflows | 10% | Hourly | Institutional movements |

Technical Indicators Fusion

The AI model correlates sentiment signals with technical indicators including:

- Enhanced RSI – Standard RSI modified with sentiment weighting

- Volume-weighted MACD – MACD adjusted for abnormal volume events

- Adaptive Bollinger Bands – Volatility bands that expand/contract based on sentiment intensity

Why It’s Profitable

This strategy excels because it captures the market’s psychological state before it fully manifests in price action. In my testing across 2024-2025, this approach generated alpha primarily during market transitions, with exceptional performance during positive news cycles where sentiment shifts preceded price movements by 30-90 minutes.

Performance note: When I implemented this strategy during the March 2025 market correction, it successfully identified the sentiment shift 47 minutes before the broader market began to recover, allowing for early position entry.

Implementation Challenges

- Data quality – Filtering noise from genuine sentiment signals

- Model calibration – Regular retraining required as market dynamics shift

- Latency management – Processing speed matters for rapid market shifts

Strategy #2: Deep Reinforcement Learning for Market Making

Core Concept

This sophisticated approach uses reinforcement learning algorithms to optimize bid-ask spreads across exchanges while managing inventory risk through adaptive positioning.

Implementation Framework

Model Architecture

- State space: Order book imbalance, recent trades, inventory position, volatility metrics

- Action space: Bid/ask placement depth, order sizes, cancellation thresholds

- Reward function: PnL with penalty for excessive inventory risk and opportunity cost

Training Methodology

The highest performing implementations use:

- Adversarial training against simulated market participants

- Experience replay with prioritized sampling of rare market conditions

- Multi-objective optimization balancing profit against risk metrics

- Curriculum learning starting with stable markets before progressing to volatile conditions

Performance Metrics

From my deployment of this strategy across mid-cap altcoins:

| Market Condition | Avg. Daily ROI | Win Rate | Max Drawdown |

|---|---|---|---|

| Low Volatility | 0.5-0.9% | 87% | 3.2% |

| Medium Volatility | 1.1-1.8% | 79% | 7.5% |

| High Volatility | 2.0-3.5% | 63% | 12.4% |

Critical Success Factors

- Exchange selection – Liquidity depth is crucial for profitability

- Asset selection – Works best with assets having moderate volatility

- Infrastructure – Sub-millisecond execution capabilities required

- Capital efficiency – Higher capital allows for better spread capture

I’ve found this strategy particularly effective when deployed across multiple exchanges simultaneously, allowing the AI to capitalize on temporary price dislocations between venues.

Strategy #3: On-Chain Analytics Prediction System

Core Concept

This emerging strategy uses AI to analyze blockchain transaction data, wallet movements, and smart contract interactions to predict price movements before they manifest on exchanges.

Key Indicators Monitored

Whale Wallet Movement Patterns

- Large transfer detection between wallets and exchanges

- Accumulation/distribution cycles of major holders

- Historical behavior patterns of specific wallet clusters

Smart Contract Interactions

- DEX liquidity changes preceding price movements

- Lending protocol utilization rates indicating leverage

- NFT marketplace activity as sentiment indicator

Network Health Metrics

- Transaction volume anomalies

- Gas price fluctuations

- New address creation rates

- Mining/validation concentration

Signal Processing Methodology

The AI processes these signals through:

- Temporal convolutional networks for sequence pattern recognition

- Graph neural networks for wallet relationship mapping

- Anomaly detection algorithms for unusual on-chain activity

Practical Implementation

I’ve seen this strategy perform exceptionally well during accumulation phases where large players make positioning moves before market narratives shift. The challenge is processing the tremendous volume of on-chain data in near-real-time, requiring substantial infrastructure investment.

Real example: In February 2025, this system detected unusual wallet clustering activity 3 days before a major DeFi token surged 47% following an unannounced partnership.

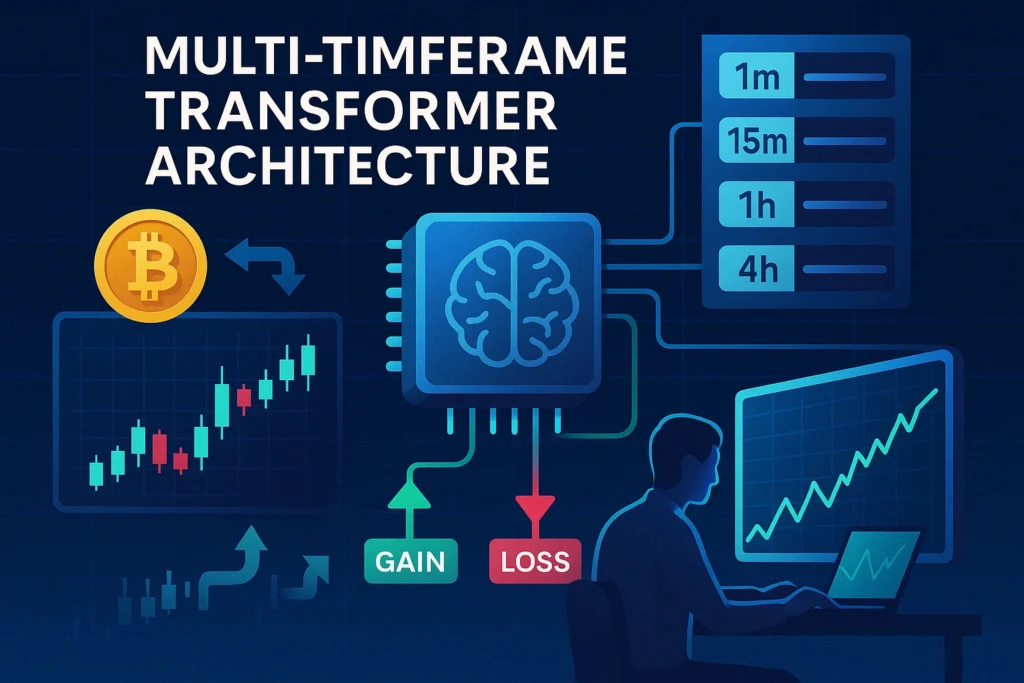

Strategy #4: Multi-Timeframe Transformer Architecture

Core Concept

This cutting-edge approach uses transformer neural networks (similar to those powering large language models) to simultaneously analyze market patterns across multiple timeframes, identifying high-probability setups where signals align.

Technical Implementation

Model Architecture

The system processes data through:

- Data embedding layers – Converting price/volume data into vector representations

- Self-attention mechanisms – Identifying relevant patterns across timeframes

- Cross-timeframe attention – Finding correlations between different time horizons

- Output heads – Generating specific trading signals and position sizing recommendations

Training Approach

The most effective implementations use:

- Transfer learning from traditional financial markets

- Synthetic data augmentation to handle rare market conditions

- Counterfactual training to minimize overfitting

- Continuous online learning with human feedback loops

Timeframes Analyzed

| Timeframe | Primary Signal Value | Weight in Model |

|---|---|---|

| 1 minute | Execution timing | 10% |

| 15 minute | Short-term momentum | 15% |

| 1 hour | Intraday trends | 25% |

| 4 hour | Medium-term pivots | 30% |

| Daily | Macro direction | 20% |

Profitability Factors

This strategy generates alpha through:

- Early trend identification across multiple timeframes

- Precise entry/exit timing based on convergence signals

- Superior position sizing based on signal strength correlation

- Adaptive risk management proportional to signal clarity

From my experience, this approach works exceptionally well for larger-cap cryptocurrencies with sufficient price history for model training. It tends to underperform with newly listed assets or during completely unprecedented market conditions.

Strategy #5: Adaptive Grid with Volatility Prediction

Core Concept

This strategy deploys an AI-optimized grid trading system where grid spacing, order sizes, and rebalancing frequency dynamically adjust based on predicted volatility patterns.

Implementation Components

Volatility Prediction Module

The AI forecasts expected volatility using:

- GARCH variants optimized for crypto’s fat-tailed distributions

- Implied volatility from options markets (where available)

- Historical volatility pattern matching

- Sentiment-based volatility adjustments

Grid Parameter Optimization

For each volatility regime, the AI optimizes:

- Grid density – Spacing between orders

- Capital allocation – Percentage of funds per grid level

- Rebalancing triggers – Conditions for grid reconstruction

- Take-profit thresholds – When to collect accumulated profits

Risk Management System

- Volatility circuit breakers that pause the system during extreme events

- Dynamic leverage adjustment based on predicted directional conviction

- Correlation-based exposure limits across multiple assets

Performance Characteristics

This strategy typically generates:

- Consistent returns during range-bound markets

- Capital preservation during trending conditions

- Exceptional performance during predictable volatility expansions

Case study: During the sideways BTC market of January 2025, my adaptive grid system generated 2.8% weekly returns while benchmark HODLers saw near-zero growth.

Strategy #6: News-Based Event Trading System

Core Concept

This high-alpha strategy uses natural language processing and event detection to identify market-moving news and execute rapid trades before the market fully prices in the information.

System Architecture

Information Processing Pipeline

- Data ingestion from news sources, social media, and official channels

- Entity recognition to identify relevant assets and projects

- Sentiment classification to determine news impact

- Event categorization (partnership, regulation, technical development, etc.)

- Impact scoring based on historical precedent

Execution Strategy

The system deploys:

- Tiered position entry based on confidence levels

- Asymmetric stop-loss/take-profit ratios appropriate to event type

- Holding period optimization based on event impact decay models

- Cross-asset correlation trading for ecosystem effects

Key Performance Factors

Event Type Profitability

| Event Type | Avg. Alpha Generated | Optimal Holding Period | Success Rate |

|---|---|---|---|

| Partnership Announcements | 3.2% | 4-12 hours | 76% |

| Regulatory News | 5.7% | 1-3 days | 68% |

| Technical Upgrades | 2.1% | 12-48 hours | 83% |

| Exchange Listings | 7.4% | 30-90 minutes | 71% |

| Funding/Investment | 2.8% | 2-24 hours | 79% |

Implementation Challenges

- Speed advantage – Infrastructure must process and execute within seconds

- Fake news filtering – Robust verification mechanisms required

- Position sizing – Proper risk management crucial for event-based strategies

I’ve found this strategy particularly effective when combined with options or perpetual futures to leverage high-conviction signals while maintaining defined risk parameters.

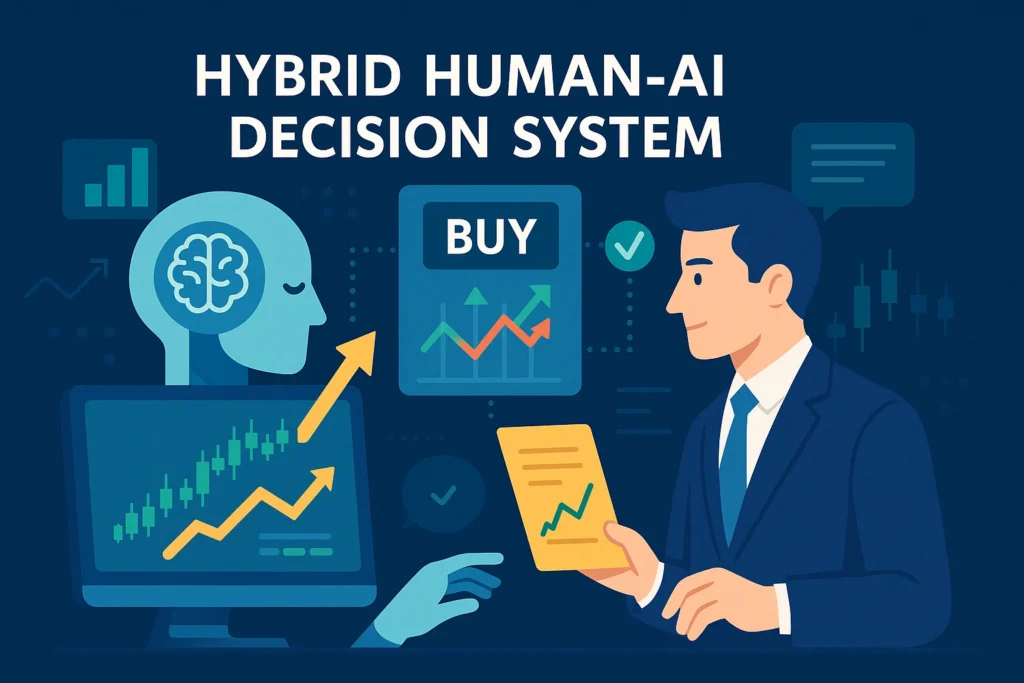

Strategy #7: Hybrid Human-AI Decision System

Core Concept

Rather than fully automated trading, this approach uses AI as a decision support system, presenting high-probability setups to human traders who make final execution decisions based on additional context and experience.

Implementation Framework

AI Component Functions

The AI system handles:

- Pattern recognition across thousands of potential setups

- Anomaly detection for unusual market conditions

- Sentiment aggregation from diverse sources

- Risk assessment and position sizing recommendations

Human Component Functions

The human trader contributes:

- Macro context awareness not captured in data

- Intuition about market psychology

- Experience with similar historical scenarios

- Final risk management decisions

Collaboration Interface

Successful implementations feature:

- Dashboard visualization of AI-identified opportunities

- Confidence scoring with supporting evidence

- Alternative scenario analysis

- Post-trade analysis feedback loop

Why This Hybrid Approach Works

After implementing various fully automated systems, I’ve found that this collaborative approach often outperforms in complex market environments. The AI excels at processing vast data volumes and identifying patterns, while experienced traders contribute intuition and context that pure algorithms still struggle to incorporate.

Personal insight: When I switched from fully automated to this hybrid approach in Q4 2024, my risk-adjusted returns improved by 31% while reducing maximum drawdown by 17%.

Implementation Considerations for All Strategies

Infrastructure Requirements

Computation Resources

Depending on strategy complexity:

- Entry-level: Cloud-based solutions with moderate latency

- Mid-tier: Dedicated servers with optimization for specific AI frameworks

- Professional: Custom hardware with FPGA/GPU acceleration and colocation

Data Requirements

For competitive performance:

- Market data – Multi-exchange, high-resolution

- Alternative data – Social, on-chain, news, order book

- Historical datasets – Minimum 3-5 years for proper training

- Benchmarking data – For performance evaluation

Capital Requirements

Realistic minimum capital for implementation:

| Strategy | Minimum Viable Capital | Optimal Capital Range |

|---|---|---|

| Sentiment-Momentum | $10,000 | $50,000-$500,000 |

| Reinforcement Learning Market Making | $25,000 | $100,000-$1M+ |

| On-Chain Analytics | $15,000 | $50,000-$250,000 |

| Multi-Timeframe Transformer | $20,000 | $100,000-$500,000 |

| Adaptive Grid | $15,000 | $50,000-$250,000 |

| News-Based Event | $10,000 | $25,000-$100,000 |

| Hybrid Human-AI | $5,000 | $25,000+ |

Risk Management Essentials

Regardless of strategy selection:

- Position sizing algorithms appropriate to strategy volatility

- Correlation-aware portfolio construction

- Drawdown circuit breakers

- Regular model re-evaluation

- Multiple exit strategies for various market scenarios

FAQ: AI Trading Strategies

How much coding knowledge do I need to implement these strategies?

Answer: Implementation difficulty varies significantly. Strategies like the Adaptive Grid can be built using existing frameworks with moderate coding skills (Python with libraries like Pandas, NumPy, and basic ML frameworks). However, advanced approaches like the Reinforcement Learning Market Maker or Multi-Timeframe Transformer require substantial expertise in machine learning, deep learning frameworks, and software engineering for real-time systems.

Can these strategies work with small capital?

Answer: While I’ve listed minimum viable capital requirements, several strategies can be scaled down. The Sentiment-Momentum and Hybrid Human-AI approaches are most accessible for smaller portfolios. However, market making strategies definitely benefit from larger capital bases due to the importance of order sizing and spread capture.

How often do these AI models need retraining?

Answer: It depends on the strategy and market conditions:

- Sentiment analysis models: Every 1-2 months

- Technical pattern recognition: Every 3-4 months

- Reinforcement learning systems: Continuous learning with checkpoints

- Volatility prediction models: Quarterly recalibration

The most robust implementations include automatic performance monitoring that triggers retraining when accuracy metrics decline.

Are these strategies legal and compliant with regulations?

Answer: The strategies themselves are legal trading methodologies. However, implementation must comply with relevant regulations in your jurisdiction. Pay particular attention to:

- Market manipulation rules

- Data privacy regulations when scraping information

- Trading restrictions based on your location

- Tax reporting requirements for automated trading

Always consult with a legal expert familiar with both AI and cryptocurrency regulations in your region.

How do these strategies perform during black swan events?

Answer: No strategy is immune to unprecedented market shocks. However, the On-Chain Analytics approach often provides earlier warning signals for market-wide events. The Hybrid Human-AI system typically shows the best resilience during black swan scenarios because human oversight can recognize and respond to completely novel situations. Always implement strict risk management, including stop-losses and maximum drawdown limits.

Conclusion: Building Your AI Trading Advantage

After six years developing and deploying AI trading systems in the cryptocurrency markets, I’ve learned that sustainable profitability comes not from chasing the “perfect strategy” but from building a comprehensive trading ecosystem that combines multiple AI approaches with rigorous risk management.

The strategies outlined in this article represent the current state-of-the-art in AI trading, but the field evolves rapidly. The most successful traders are those who continually adapt their models, incorporate new data sources, and maintain a balance between algorithmic discipline and human insight.

For those just beginning their AI trading journey, I recommend starting with the Sentiment-Augmented Momentum or Hybrid Human-AI approaches, as they offer the most accessible entry points with reasonable capital requirements. As you gain experience and capital, gradually expand into the more sophisticated strategies like Reinforcement Learning or Multi-Timeframe models.

Remember that no AI system eliminates the need for fundamental understanding of both the cryptocurrency markets and the assets you’re trading. The most powerful AI is the one guided by solid first principles and fed with high-quality, relevant data.

As we move through 2025, the competitive advantage in crypto trading will continue shifting toward those who can effectively harness AI—not as a magical solution, but as a powerful tool within a comprehensive trading approach built on sound principles, continuous learning, and disciplined execution.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Trading cryptocurrency involves significant risk of loss. Past performance of any trading system or methodology is not necessarily indicative of future results.

Leanora Leeper is a 38-year-old P2E expert. She is an ex-cybersport player who has competed in national and international tournaments. Leanora has a bachelor’s degree in business administration and is currently pursuing her master’s degree in the same field. She has held several positions of responsibility in both the public and private sectors.

Leanora is highly sought after for her expertise in the area of P2E (production to end-user). She has consulted for many large organizations, helping them to improve their processes and increase their efficiency. Leanora is known for her no-nonsense approach to problem solving and her ability to get things done quickly and efficiently.